What is Indian Business Portal?

Indian Business Portal is a B2B digital marketplace by Federation of Indian Export Organisations (FIEO) to empower SME exporters to identify new markets for their products and grow their sales with new buyers.

If you are an Indian Exporter, get started today with your online store on FIEO GlobalLinker and get your products listed on Indian Business Portal.

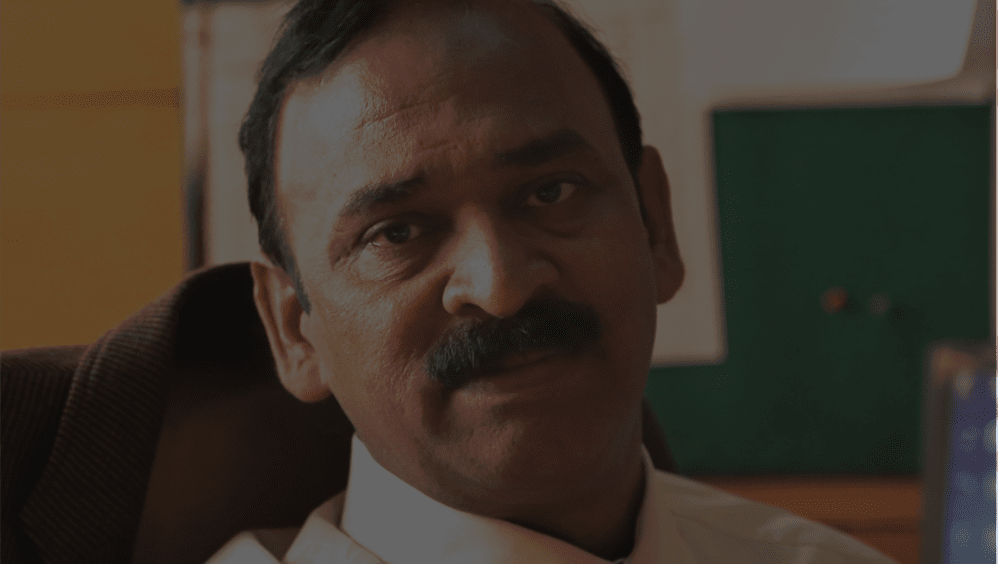

Dr. Ajay Sahai

Director General & CEO, FIEO

“ Indian Business Portal is a B2B digital marketplace by Federation of Indian Export Organisations (FIEO) to empower SME exporters to identify new markets for their products and grow their sales with new buyers. „

Create Digital Catalogue in 5 Easy Steps

Sign up by providing few basic details

Choose Design Temple & create catalogue URL

Upload products and setup navigation

Apply theme and upload banners

Submit request for listing

Video Tutorials

Subscribe to our channel for latest tips and tutorials

Help Center

Digital Catalogue Helpline: 022 4893 1735

Assistance in English and Hindi from 9am to 5pm (Monday - Friday)

Queries related to Indian Business Portal, FIEO Membership and Export

Frequently Asked Questions