Make the ‘sahi’ choice of Mutual Fund

Finance & Accounting

309 week ago — 5 min read

Background: A mutual fund is a managed portfolio of traded financial instruments that is formed by a financial institution by bringing a large group of people together and investing money on their behalf. Each investor in mutual fund owns shares which represents a portion of their holdings. This pool of money is invested in various asset classes like liquid assets, debt funds, stocks, bonds and so on. You can either invest directly with a mutual fund or hire the services of a mutual fund advisor. There are so many mutual funds in India (equity funds, fixed-income funds, index funds and balanced funds) you can choose from depending on the kind of security you want to invest in, investment objectives and the returns expected. Picking the right mutual fund that meets your goals requires a bit of due diligence from your end. In her previous article, Financial Advisor Usha Mallya explains how insurance doesn’t necessarily mean investment. In this article she explains few basic points that you need to keep in mind before choosing the mutual fund right for you.

So much is written about mutual funds in the newspapers on a daily basis, the advertisements too say “mutual funds sahi hai” (mutual funds are great). Yes that’s true, provided you know which fund is ‘sahi’ (right) for you.

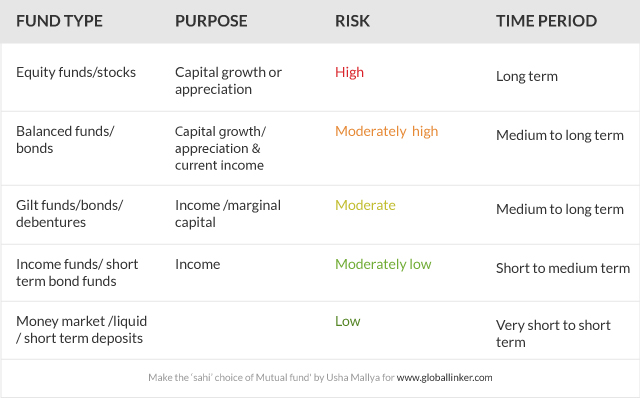

Each mutual fund scheme is meant for a specific purpose and has to be invested for a certain period in order to achieve that purpose.

With so many mutual fund schemes on the shelf, choosing that one fund which will work for you and help achieve your goal can be quite a challenging and daunting task. We tend to take the easy way out and go by our friend’s choice or recommendation or decide based on emails, advertisements, etc. Nothing wrong in that and you can keep asking or checking around. Because remember, everyone doesn’t have the same goals, timelines or even same kind of money to invest. So your investment path could well be different from that of your friend or acquaintance.

Here are a couple of simple and easy to understand points to consider while choosing the right mutual fund:

1. Firstly understand this, each mutual fund scheme is meant for a specific purpose and has to be invested for a certain period in order to achieve that purpose and lastly carries a specific risk. Each mutual fund product is generally classified in specific category that kind of defines it.

For example at the base level, there are cash management /liquid funds/money market funds, meant for short time frames like 15 days to one month or less than three months. These funds are meant for preserving your capital at the same time earning a return slightly higher than your savings account. The risk in this is low.

2. At the highest level, there are equity funds, these are investments meant for long time frames e.g. 5 + years. These funds are for growth of your capital invested; needless to say the risk in these investments is high.

3. In between the above two fund types, are a mix of liquid/ debt/ income funds and equity funds and the risk escalates as the investments move towards complete equity. To make it simple, I have put it down in a tabular format.

4. Look up the product label that each mutual fund product is supposed have in the offer documents. This label is just like the nutritional facts label that you will see on food items. It is supposed to have:

- Nature of scheme such as to create wealth or provide regular income in an indicative time horizon (short/ medium/ long term).

- A brief about the investment objective (in a single line sentence) followed by kind of product in which investor is investing (equity/debt).

- Level of risk, depicted by colour code boxes.

For example:

The above table and the label should help in choose your path and lead you to your destination.

Happy investing!

Image courtesy: www.pexels.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Usha MallyaFinancial Advisor, Financial Blogger, Conduct Financial Education workshops for Women, Financial Coach

View Usha 's profile

Other articles written by Usha Mallya

310 week ago

Most read this week

Comments

Share this content

Please login or Register to join the discussion